Never Miss a

Deduction Again

How to maximise every deduction, written in plain English.

Our guide didn't help you claim more? We'll give you your money back.

Updated for COVID19

FY20/21 wasn't your typical year, but we've got you covered.

Tax Deductible

The cost of this guide is tax deductible in this financial year.

Understand how to claim more

Every type of deduction is covered in detail, understand the rules without the jargon. Get the tips and strategies to maximise your tax refund this year. You don't need a Finance degree to read this book!

Sample Content

We've got you covered

Deductions in the Guide

For each deduction the guide covers rules & guidelines, detailed examples, do’s and dont’s and the most frequently asked questions from the community.

- Working from home (Updated for 20/21)

- Mobile phone & tablets

- Car & travel expenses

- Tools & equipment

- Clothing expenses

- Union & association expenses

- Gifts and charitable donations

- Costs of managing your tax affairs

- Interest & dividend deductions

Sample Content

Already submitted your taxes?

Playbook, not a rulebook

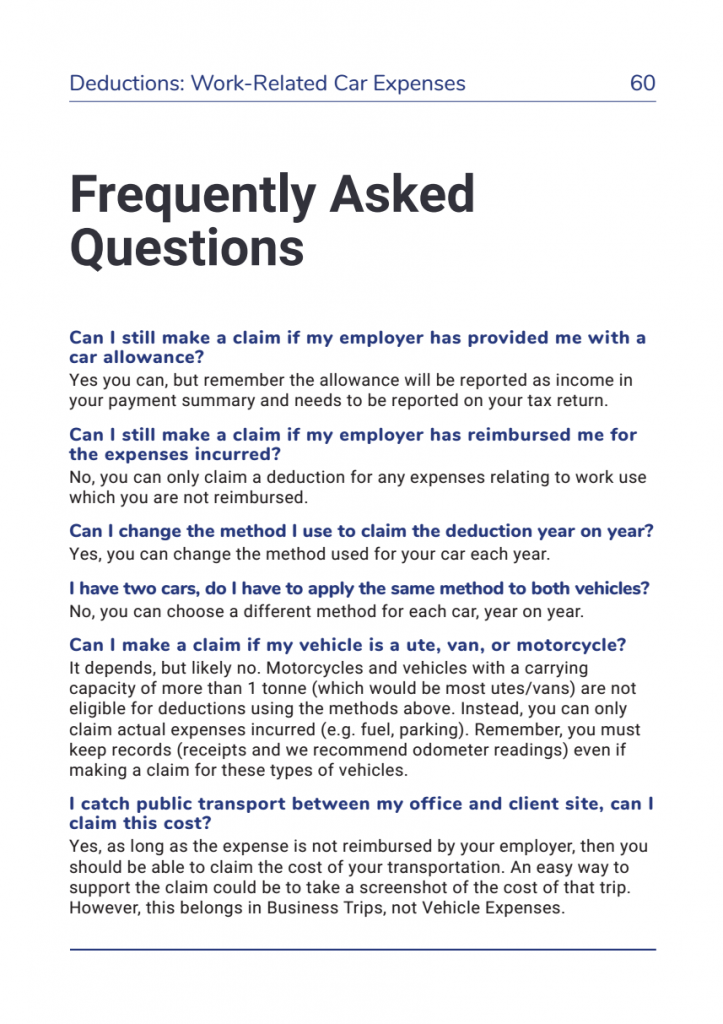

Learn how to optimise your spending and behaviour by understanding what is and isn't deductible before you make your purchase. Learn from our Frequently Asked Questions to see what others are doing, and learn to avoid the common pitfalls!

Frequently Asked Questions

What do I get with this guide?

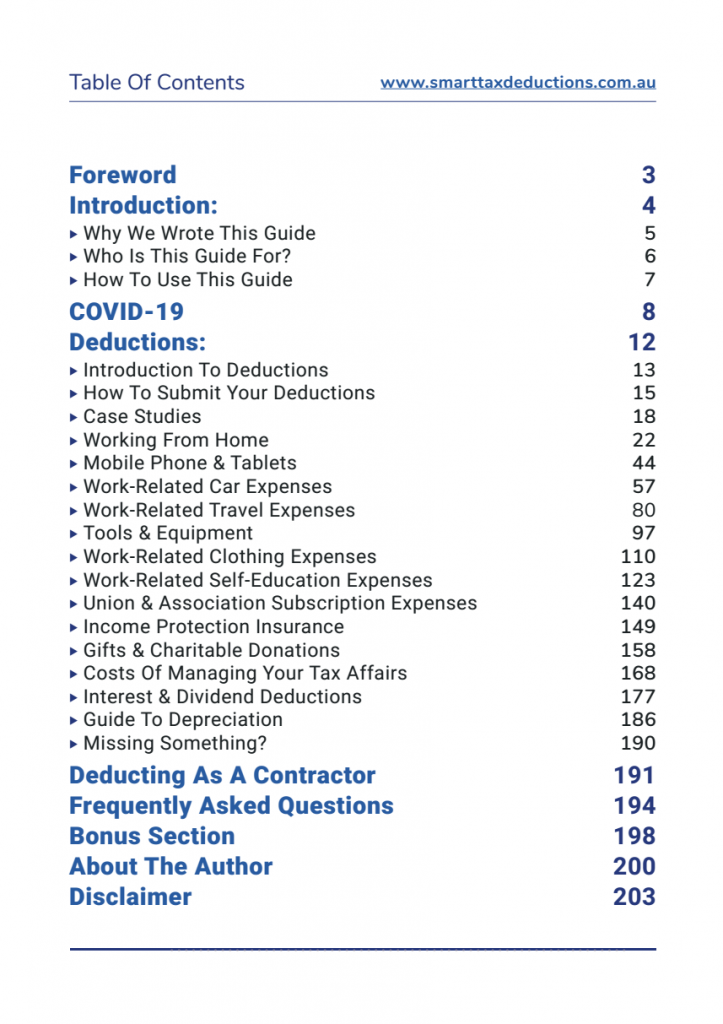

Our Ultimate Tax Guide has 200 pages of valuable information written in plain English.

It includes 11 of the most common deductions are covered in detail, including:

- Working from Home

- Mobile Phone & Tablets

- Travel Expenses

- Tools & Equipment

- Clothing

- Union & Association Subscription Expenses

- Income Protection Insurance

- Gifts & Charitable Donations

- Costs of Managing Your Tax Affairs

- Interest & Dividend Deductions

Each Deduction has:

- Rules of Play explaining what you can and can’t do.

- Realistic examples which are worked through from start to finish.

- Frequently Asked Questions from our community. Nearly 100 in the book.

- Scenarios for Best Practice, Caution and No-No claims.

- How and where to submit on MyTax.

Once you purchase the eBook it is sent immediately to you via email.

Which version should I buy?

The guides are largely the same, however the worked examples for each Deduction have been modified to be as relevant as possible for their target audience.

If you work in an office you should buy the Guide for Office Workers. Everyone else will likely benefit more from the diversity in the examples within Guide for Australians.

If you’ve bought one version and realised the other may have been more relevant, please contact us and we’ll gladly sent you the Examples from the other guide free of charge.

Can I amend a past tax return?

This is a tough one – you would have to balance the difference between the extra tax you could save versus the administrative requirement of lodging what is called an ‘amended return’ and the fact that the ATO may get curious as to why you’re amending a return (should be no issues if you have substantiation). This is also the case if you’ve already submitted your 2019/20 return.

You must also consider if you are even allowed to per the time bar rules. The time bar rules dictate that there is a time limit on when you or the ATO can amend your tax assessment – the period being 2 years (except if the ATO suspects you of fraud or tax evasion). The two years starts from the day after the ATO issues the Notice of Assessment for the year in question (taken to be the date on the notice). For example, if you lodged your 2018/19 return and the ATO issued their Notice of Assessment on 1 April 2020, your two year window would end 31 March 2022.

Can this replace my accountant?

Of course you’d expect us to say Yes! But in reality, it depends.

If you are a full time employee (as opposed to a sole trader or freelancer) and want to understand tax deductions, this guide should be sufficient for the majority of people. The guide contains more information than your accountant would ever have time to explain to you.

However, everyone has unique circumstances, and especially if you have complex tax affairs (e.g. complex investments, run your own business), seeing an accountant could be the better option. In those circumstances the guide still helps to keep you better informed, and to make sure your accountant is being thorough when it comes to deductions.

However, the guide will offer a level of detail that your accountant won’t have time to teach you. By being better informed about what can and can’t be deducted, you’ll learn how to spend smarter in the future!

Is the cost of this guide deductible?

Yes! You can deduct the cost of this guide under Managing Your Tax Affairs in myTax.

Why did you write this book?

Years ago I was in your shoes, it was tax time and I was scouring the internet for information on tax deductions. The ATO website was difficult to understand, generic and vague. Other articles I found were just trying to upsell me to a consultation.

My experience with accountants in the past was that they wanted to service you in the most efficient way possible. Unless it was big ticket items it wasn’t worth their time. But the medium and small ticket items add up, and they mattered to me. And every tax time I’d realise there were smarter ways that I could’ve spent my money, to get more out of my deductions.

I’d spent my career in Consulting and Technology, so I teamed up with two tax experts with over 20 years of combined experience in Tax Advisory to write this book. We believe that the information isn’t complicated, and you shouldn’t have to pay hundreds of dollars to sort out your deductions!

Author,

Haichen Wang

How much money can I save?

This is a tricky question and will obviously be different for everyone. There are two types of benefits to understanding tax deductions:

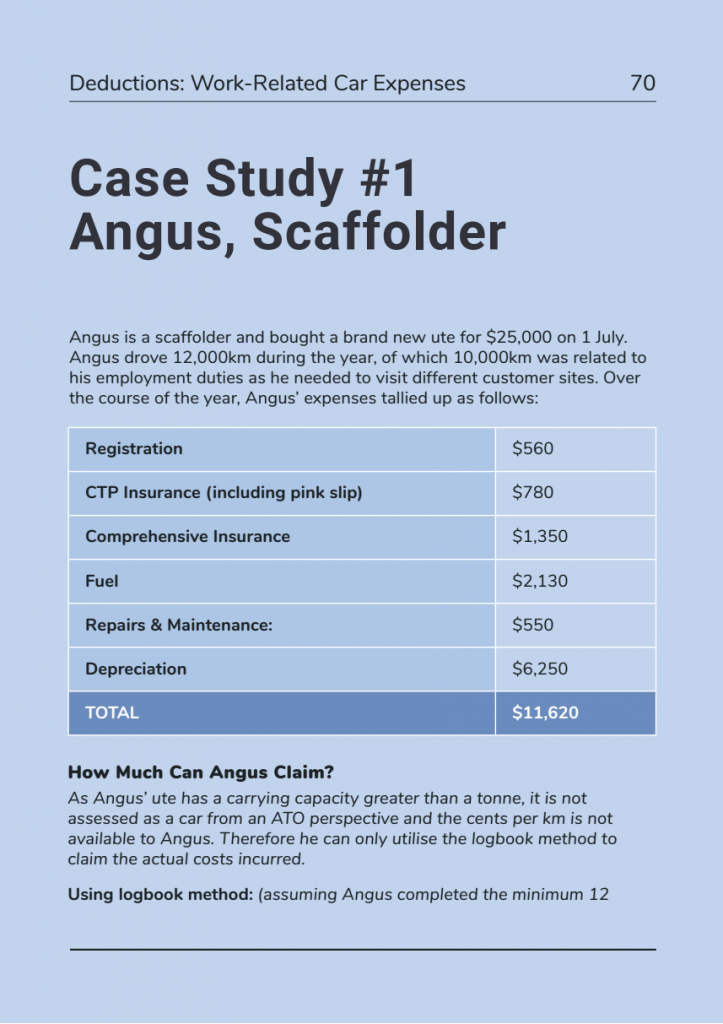

Reactive – Rulebook

You use the guide as a rulebook to check what you can and can’t deduct, and the best ways to calculate your deduction. An example of this might be figuring out which of the three Working from Home cost calculations to use, or if the flat rate or logbook method of Car Expenses is better for you, or which Tools are deductible for someone in your situation.

Proactive – Playbook

You use the guide as a Playbook to make more strategic decisions around your purchases and how you use them. Understanding what types of Self Education or Car expenses are deductible impacts our spending habits. When is an MBA deductible? Are luxury vehicles deductible? What if I leased the vehicle?

At the end of the day you could save anywhere from an extra few hundred dollars from home office expenses, to a few thousand for vehicle expenses, to tens of thousands for an MBA.

What are the key tax dates?

The Australian financial year ends on 30th June. You have from 1 July to 31 October to lodge your tax return for the previous financial year. If you lodge your tax return after 31 October, you may be charged interest if your tax return concludes you owe money to the ATO. So make sure you don’t miss a deduction!

If you use a registered tax agent to prepare and lodge your tax return, you may be able to lodge later than 31 October.